by Admin | Oct 28, 2021 | Capital allowances

In the Spring Budget earlier this year, the government announced that the temporary Annual Investment Allowance (AIA) cap of £1 million would be extended until 31 December 2021. The Chancellor, delivering the Autumn Budget revealed that the temporary cap will...

by Admin | Aug 12, 2021 | Capital allowances

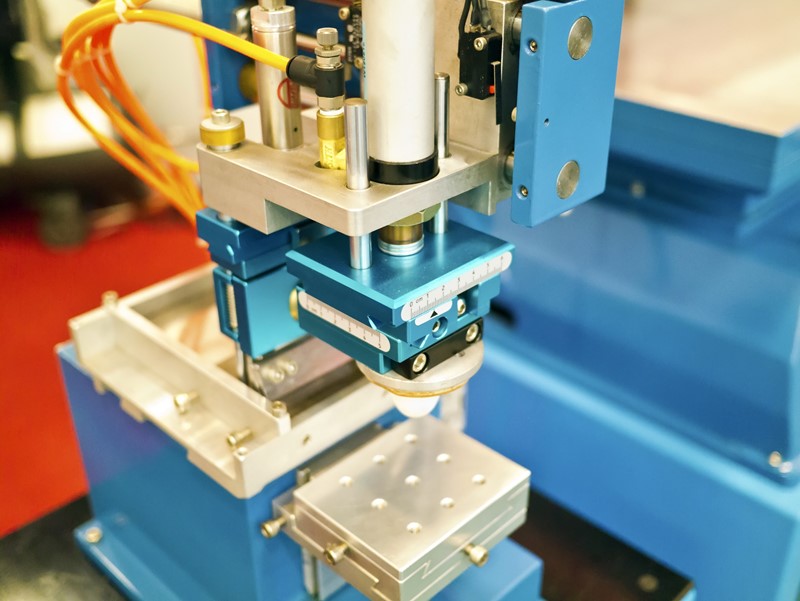

Are you thinking of investing in new plant or other equipment? Remember that the super-deduction offering 130% first-year tax relief is available to companies until March 2023. The super-deduction tax break was introduced on 1 April 2021 and allows companies to...

by Admin | Aug 5, 2021 | Capital allowances

Capital Allowances are the deductions which allow businesses to secure tax relief for certain capital expenditure. Capital Allowances are available to sole traders, self-employed persons or partnerships, as well as companies and organisations liable to Corporation...

by Admin | Jun 3, 2021 | Capital allowances

There are special rules that must be followed when you sell an asset on which capital allowances have been claimed. Capital allowances is the term used to describe the tax relief businesses can claim on certain capital expenditure and thereby reduce the amount of...

by Admin | Nov 19, 2020 | Capital allowances

In a welcome move, the government has announced that the temporary Annual Investment Allowance (AIA) cap will be extended for a further 12 months until 1 January 2022. The government says that this move is intended to boost confidence as companies look to weather the...

by Admin | Oct 22, 2020 | Capital allowances

The Annual Investment Allowance (AIA) allows for a 100% tax deduction on qualifying expenditure on plant and machinery to be deducted from your profits before tax. The relief is normally capped at £200,000 per annum but was temporarily increased to £1...

Recent Comments