by Admin | Dec 8, 2022 | Capital allowances

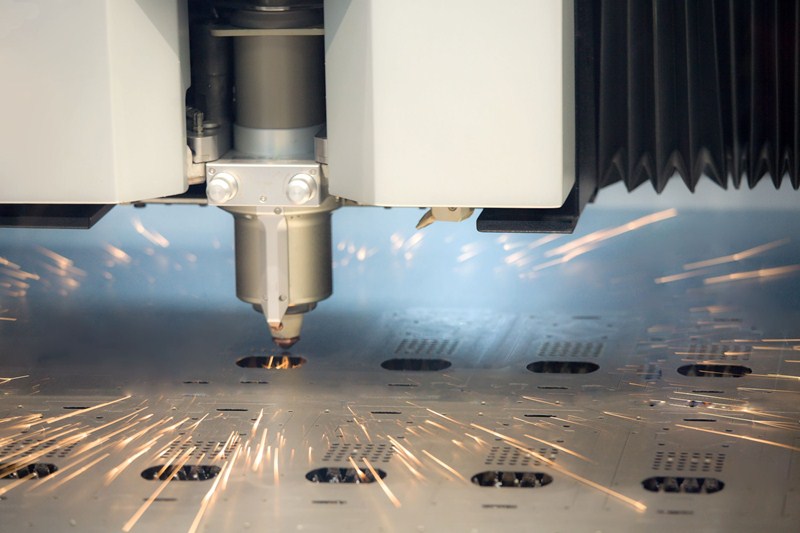

Time is running out to claim the super-deduction offering 130% first-year tax relief. The deduction is available to companies until March 2023. The super-deduction was designed to help incorporated businesses finance expansion after the coronavirus pandemic and to...

by Admin | Nov 3, 2022 | Capital allowances

Businesses can claim a 100% first-year allowance (FYA) on the purchase of certain qualifying Plant and Machinery (P&M). The cash-flow benefit of accelerated tax relief is designed to encourage businesses to invest in capital items which help reduce their carbon...

by Admin | Sep 29, 2022 | Capital allowances

A Writing Down Allowance (WDA) is available for plant and machinery expenditure that exceeds the Annual investment allowance (AIA) and / or does not qualify for a First-Year Allowance as well as for residual balances of expenditure that has been carried forward from...

by Admin | Mar 24, 2022 | Capital allowances

If you are thinking about purchasing a company car through a limited company, there are many issues that need to be considered. In this short article we will point out some of the main issues to be aware of, but it is important to properly research this area and weigh...

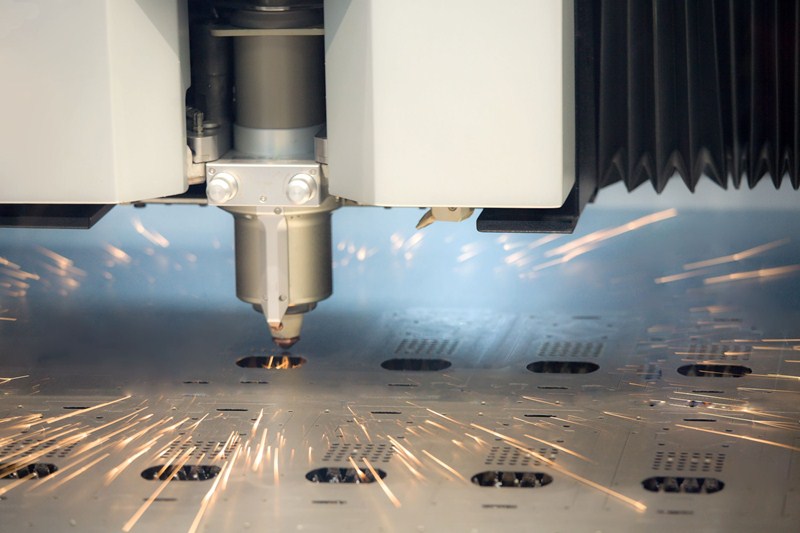

by Admin | Mar 3, 2022 | Capital allowances

Capital allowances are the deductions which allow businesses to secure tax relief for certain capital expenditure. HM Treasury has published a factsheet on the super-deduction offering companies a 130% first-year tax relief from 1 April 2021 until 31 March 2023....

by Admin | Nov 25, 2021 | Capital allowances

The Structures and Buildings Allowances (SBA) facilitates tax relief for qualifying capital expenditure on new non-residential structures and buildings. The relief applies to the qualifying costs of building and renovating commercial structures. The...

Recent Comments