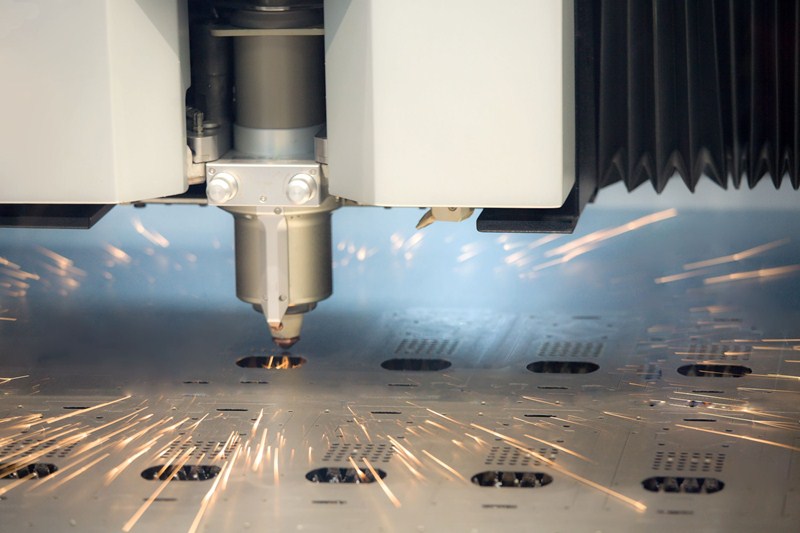

by Admin | Mar 3, 2022 | Capital allowances

Capital allowances are the deductions which allow businesses to secure tax relief for certain capital expenditure. HM Treasury has published a factsheet on the super-deduction offering companies a 130% first-year tax relief from 1 April 2021 until 31 March 2023....

by Admin | Mar 3, 2022 | Value Added Tax

The VAT domestic reverse charge accounting mechanism was put in place to help prevent criminal attacks on the UK VAT system by means of sophisticated fraud. The domestic reverse charge procedure applies to the supply and purchase of the certain specified goods and...

by Admin | Mar 3, 2022 | Employment & Payroll

The Coronavirus Statutory Sick Pay Rebate Scheme has allowed small and medium-sized businesses and employers reclaim Statutory Sick Pay (SSP) paid for sickness absence due to COVID-19. The online service initially closed for new claims after 30 September 2021....

by Admin | Mar 3, 2022 | Income Tax

If you are an employee, you may be able to claim tax relief for using your own vehicle, be it a car, van, motorcycle or bike. There is generally no tax relief for travel to and from your place of work. The rules are different for temporary workplaces where the expense...

by Admin | Mar 3, 2022 | General

The government has published its latest guidance on COVID restrictions and specifically on the new phase we have entered of ‘Living with COVID-19’. This has effectively moved the country into a new phase of living with COVID and marked the end of...

Recent Comments